First trade recommendations

Helping new users make their first investment with confidence

Problem

Around a third of customers who join Robinhood never place a trade. User research told us that many of them hesitate because they lack the domain knowledge and confidence to decide what to invest in.

Solution

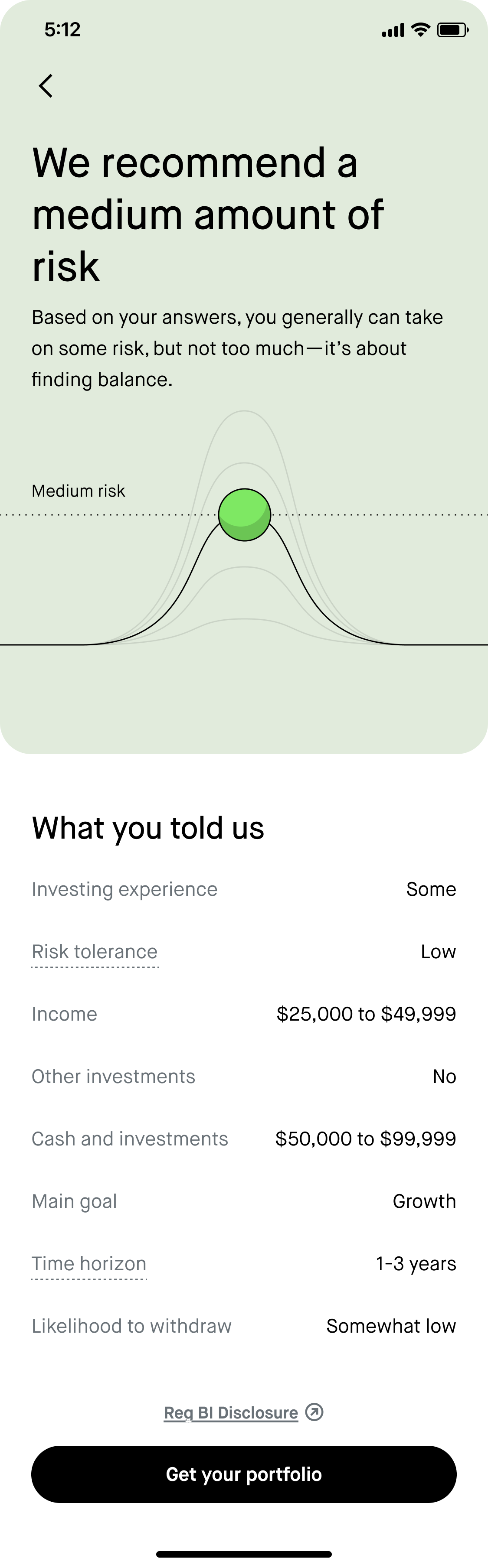

We designed an immersive experience where the customer answers a set of questions, learns which level of investing risk is right for them based on their answers, and then is recommended a small, diversified portfolio of four exchange-traded funds (ETFs) that matches their risk level. They can then invest in that portfolio in a bulk checkout flow. To make investment recommendations as a self-directed broker-dealer, we have to comply with the SEC's Regulation Best Interest.

My key contributions

I led end-to-end UX content design, provided feedback on product requirements and early designs, iterated during user research, wrote all customer communications and Help Center content, and designed the in-app customer support triage flow while collaborating with five Legal and Compliance partners.

This was the first product to transition Robinhood from an entirely self-directed broker-dealer to one that makes recommendations to customers. That's a big deal! With so many eyes on the project from all sides of the business, I had to be able to clearly articulate my rationale for every content decision.

The keys to our success were gradual information progression, narrative storytelling, and functional visuals aligned with content.

The questionnaire

The experience begins with introductory screens leading into a questionnaire assessing the customer's investing needs to match them with a risk level. The questionnaire underwent at least 6 rounds of revision and review from stakeholders across product, legal, and compliance.

Screen title

Add your rationale for this screen here.

The portfolio walkthrough

This section presents new information sequentially in an immersive, narrative experience. Customers learn about ETFs, diversification, and the specific ETFs in their portfolio.

Screen title

Add your rationale for this screen here.

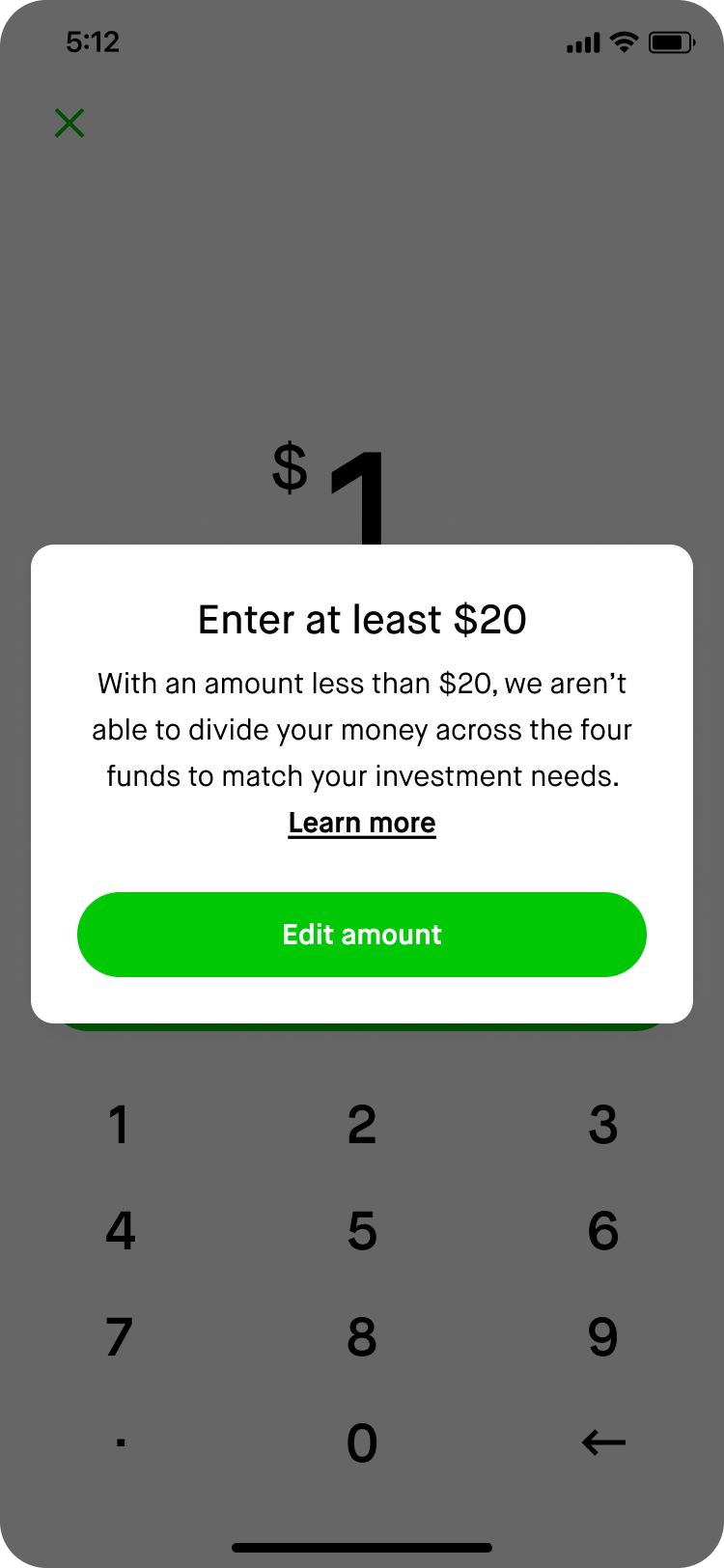

The trade flow

Once committed to investing, customers link their bank, transfer funds, and invest in one continuous flow. Several screens reusing other teams' designs (bank linking, fund transfers) were excluded from this breakdown.

Screen title

Add your rationale for this screen here.

Legal and compliance process

Hands down, the most challenging part of this project was getting Legal and Compliance approval on all of the different content pieces. I needed 2 lawyers and 3 Compliance principals to sign off on over 200 screens, a set of customer communications, and a Help Center article. I grouped these different pieces of content for approval and established a cadence for reviewing work. I balanced different communication styles, availabilities, and competing priorities across these 5 stakeholders, often meeting several times a weeks with folks to understand and respond to their feedback. I had to be able to articulate my rationale behind nearly every content decision and learn how to push back on feedback I disagreed with. It was tough, but working through it ultimately strengthened my relationships with those folks and made me a better content designer.

Outcomes

We drove a statistically significant increase in first trade and long-term activity rates among our target audience.

Flow completion was higher among less-experienced investors. We also saw higher adoption among women and investors under age 20.